August 17, 2018

Acting Administrator Andrew Wheeler

Environmental Protection Agency

1200 Pennsylvania Ave. NW

Washington, D.C. 20460

Re: Docket ID EPA-HQ-OAR-2018-0167

Dear Acting Administrator Wheeler:

The Illinois Corn Growers Association (ICGA) and the Illinois Renewable Fuels Association (ILRFA) are pleased to submit comments concerning the proposed EPA rulemaking regarding the establishment of renewable fuel volume numbers for 2019 and biodiesel volumes for 2020. The ICGA represents over 5000 corn growers in Illinois and is the second largest corn producing state in the U.S. This year, according to the latest U.S. Department of Agriculture (USDA) forecasts released on August 10, 2018, Illinois will produce over 2.246 billion bushels with a record-breaking yield of 207 bushels per acre.

The ILRFA represents nine companies and twelve production facilities. The ethanol industry in Illinois produces over 1.7 billion gallons of ethanol per year. The ethanol produced in Illinois would provide 40% of Illinois’ gasoline requirements if many of the archaic and unfair regulatory barriers were lifted. The ethanol produced in Illinois corn is shipped to areas throughout the Midwest and to the east coast where it helps to reduce harmful emissions while reducing gasoline prices to all consumers. The Illinois ethanol industry also exports more ethanol than any other state to markets such as Brazil, India, and Canada. Given the volume destruction we have seen through EPA granted exemptions, the export market has been the difference between profitability and losses for the ethanol industry.

ICGA and ILRFA are very concerned about how EPA is implementing the Renewable Fuel Standard (RFS) and meeting the original intent of Congress when it passed the RFS 2 in 2007. Congress wanted clean, renewable fuels to help reduce our dependence on oil and reduce carbon emissions through the substitution of renewables for petroleum-based transportation fuels. The intent of the RFS was to create a demand pull for renewable fuels in both the gasoline and diesel markets which would increase market share for renewables. It was clear that the petroleum industry was not going to use renewable fuels without the RFS requirements. Unfortunately, EPA has not implemented or managed the RFS as intended. This goes back to 2014 when the Renewable Volume Obligation (RVO) numbers for conventional ethanol were being reduced as the industry was producing nearly 15 billion gallons of ethanol per year. Now EPA has created a glut of surplus Renewable Identification Numbers (RIN) in the market which effectively ensures that the petroleum industry does not have to move higher blends into the market as prescribed by Congress. It has been stated that EPA has granted exemptions for over 2.2 billion gallons of ethanol and still considering additional exemptions. Unless these volumes are reallocated there will be no incentives to increase blending and the RFS fails in the original intent.

A quick look at the price of ethanol over the last two years compared to the posted prices of the BOB which ethanol is blended into shows the enormous price savings on the ethanol side. Ethanol this week is $0.62 below RBOB gasoline as reported on the Chicago Board of Trade. For most of this year, ethanol has been trading at seventy cents below gasoline (RBOB) which means the petroleum industry is receiving a heavily discounted octane additive. Unfortunately, by not implementing the RFS as intended by Congress, the consumers are losing out on significant savings at the pump. These savings could be as much as $4 billion annually. These numbers prove that ethanol that could go into the market through an effectively managed RFS program and regulatory relief is being stranded. The current prices of D6 RINs (20-25 cents) for the last five months also indicates no movement to expand renewable fuel markets through EPA enforcement.

Even though EPA does not understand or feel the ramifications of their proposed RVO requirements for 2019, these consequences are real and very impactful for agriculture, the ethanol industry and rural America. The ethanol plants, even with low corn prices, are facing low margins and many have profitability concerns. Increasing ethanol exports have helped maintain ethanol industry profitability since the domestic market is not growing under the current RFS management. Ethanol exports this year is expected to reach 1.4 billion gallons which is approximately 200 million gallons above last year.

Ethanol margins are low and industry profitability is hurting but that is not the case for the oil industry which EPA is careful to protect through “hardship exemptions” for small refineries. Oil companies such as Chevron, Exon/Mobil, Shell and BP are making near record profits this quarter and last. As energy commodities moved higher in the last quarter, only the price of ethanol moved lower. If EPA would reallocate the exempted gallons there would be more alignment in the ethanol and oil markets.

Corn growers throughout the U.S. and Illinois are struggling even more than the ethanol industry. Corn farmers are growing bigger crops through higher yields everywhere, and on less acres. The USDA published their latest forecast on crop production and yield on Friday, August 10, 2018, predicting a 2018 corn crop of 14.6 billion bushels averaging 178.4 bushels per acre (bpa). When the RFS2 was passed in 2007, the average corn yield was 150 bpa and in 2017 it increased to 176.6 bpa. According to USDA, the planted corn acres in 2018 are more than 3 million acres less than what was planted when the RFS2 was passed in 2007 and 7 million acres less than in 2012. This makes EPA’s earlier concerns about direct and indirect land use change unfounded which has been an argument by the states and NCGA since 2007.

The impacts from low corn prices and poor profitability are moving through the corn belt and rural America. Lack of growth in ethanol demand because of RFS volume destruction and the fears around tariffs and destruction of trade agreements are creating financial instability particularly with young farmers and their families.

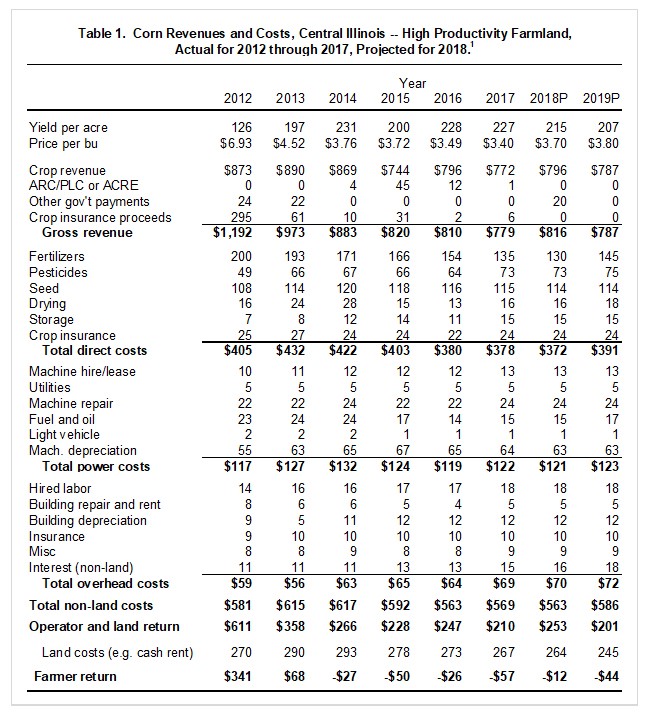

Recently, Dr. Gary Schnitkey wrote an article in Farm Doc entitled “Corn and Soybean Budgets for 2018 and 2019: Low Returns Ahead” The table above is from that article, showing farmer returns per acre for corn in central Illinois. [Reference: Weekly Farm Economics: Corn and Soybean Budgets for 2018 and 2019: Low Returns Ahead Gary Schnitkey Department of Agricultural and Consumer Economics University of Illinois August 7, 2018 farmdoc daily (8): 146 Table 1 shows corn budgets grown on high-productivity farmland in central Illinois. Actual results for 2012 through 2017 are summaries from grain farms enrolled in Illinois Farm Business Farm Management (FBFM). Projections are made for 2018 and 2019.]

As the table shows, an average central Illinois corn grower is facing the 6th year of negative returns per acre. This is very troubling because it means farmers will not be able to invest in the latest technologies, more efficient equipment, the best seed technology and other inputs. This hurts the rural communities and every agriculture service company in the community. More importantly, the poor financial positions of the farming operations discourage young families from moving back to the farms. With these returns, it has become difficult for some farmers to obtain seasonal loans to even be able to plant a crop next year. When this happens, we begin seeing liquidation sales and foreclosures.

The alarming takeaway from this table for any person in public policy is this is a representation of central Illinois agriculture. This area has some of the most productive land in the world, great climate for growing corn and beans with minimum risk, and some of the best farmers. Furthermore, central Illinois enjoys very strong markets for corn and beans including large processors, rail loaders, and a river transportation system that can hit markets throughout the world. Dismantling the RFS through waivers, lack of enforcement, maintaining regulatory barriers and RIN destruction will continue to negatively impact the farm economy.

What should EPA do in this rulemaking and other regulatory actions?

- EPA should reallocate waived gallons to keep the final RFS whole for 2019 volumes

ICGA and ILRFA urge EPA to maintain the statutory intent for establishing the annual RVO numbers. Not including in these proposed rules for 2019 RVO numbers a request for comment on how to account for the previously awarded exemptions is not maintaining the integrity of the RFS. These exemptions must be included in the formal calculations for percentage standards that apply to all gasoline and diesel produced or imported in 2019. What is very upsetting is that EPA originally, in its draft comments, determined that it would account for the retroactive small refinery exemptions and keep the volume requirements set in this rule whole according to provisions established in the Clean Air Act. EPA was originally taking the correct action. Now, since these are not included, EPA is in effect dismantling the RFS.

- EPA needs to incorporate the small refinery exemptions issued for 2016 and 2017 compliance years in the 2019 obligations in this RVO rulemaking

This 2019 RVO rulemaking provides the opportunity for EPA to make the RFS whole by ensuring the RFS volumes set for 2016, 2017, and 2018 are achieved despite exemptions that have been granted. EPA has a statutory duty to ensure final volume requirements are met. Due to the retroactive exemptions EPA issued, the required renewable fuel volumes for 2016 and 2017 have not been met. Failure to make up these previous exemptions is equivalent to issuing a general waiver based on “inadequate domestic supply” or “severe economic harm.” EPA does not have legal standing to treat the exemptions granted in 2016 and 2017 in this manner.

- Comply with the court’s remand and address the 500 million gallons improperly waived in 2014-2016 RVO standards

ILRFA and ICGA urge EPA to include the 500 million gallons remanded back to EPA by the United States Court of Appeals for the District of Columbia Circuit for reallocation in the 2019 RVO rules. EPA has had a full year to comply with the Court’s remand order and to address the improperly waived 500 million gallons. The Court determined that more than 500 million gallons were improperly waived by EPA through their violation of the statute, but those gallons will never be recovered. EPA has an obligation to the Court and to the citizens of the U.S. to reallocate these volumes which EPA incorrectly waived and to do so in a timely manner. This should be a huge embarrassment to EPA by shining a light on how they implement the RFS to the detriment of the citizens, agriculture, the renewable fuels industry and the environment. We would think EPA would want to get this embarrassment and lack of judgement behind them as quickly as possible.

- Grant the same summertime RVP waiver for all blends above E10 as what E10 receives

If EPA was serious about the success of the RFS2 and moving biofuels beyond the blend wall, then a 1psi Reid Vapor Pressure (RVP) waiver for blends above E10 blended in the summer months in conventional gasoline should have already been approved and the RFS would be working according to Congressional intent. RIN prices would have been competitive and actual volumes would have been available to the public for their savings and air benefits. This waiver would allow the petroleum marketers to use the same blend stock for E15 as they currently use in blending E10. This would further reduce the price of the fuel to the consumer with ethanol trading at 62 cents below gasoline. Right now, petroleum marketers must decide if they will offer E15 as a flex-fuel in the summer months or purchase an expensive boutique BOB so they can sell E15 throughout the year. This is a huge weight to put on petroleum marketers and is very confusing for gasoline customers. EPA has the authority to fix this injustice.

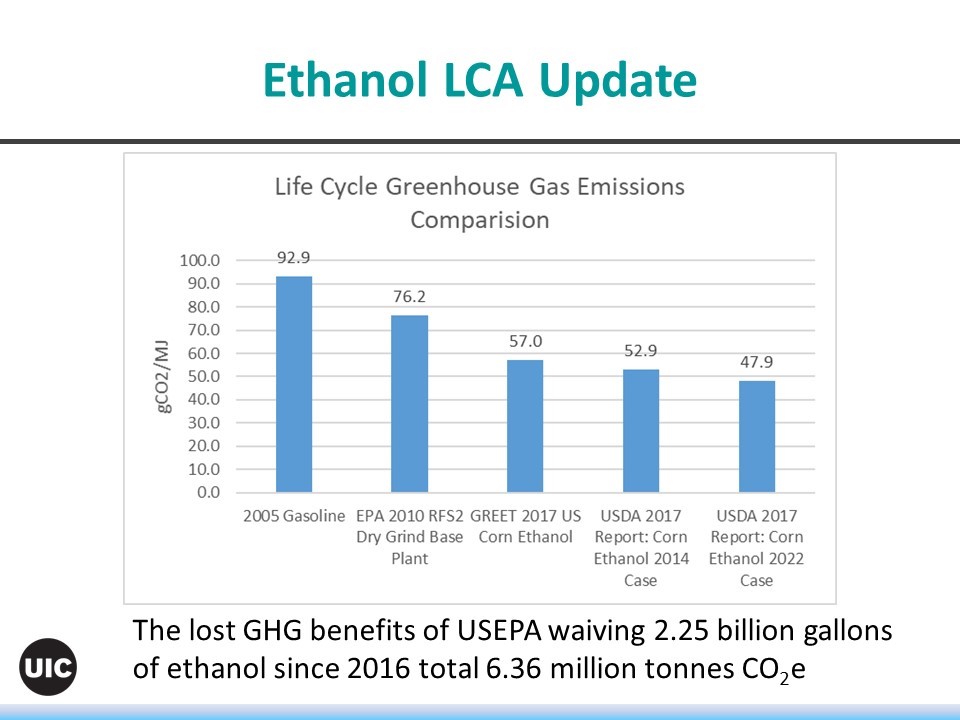

- Update the greenhouse gas emissions reductions realized with corn starch ethanol based on the recent body of science and publications

EPA has assumed that corn starch ethanol would be 20% better than baseline gasoline by 2022 with the addition of specified technologies incorporated in the new plants and expansions constructed after 2007. Plants on-line or under construction when the Energy Independence and Security Act was passed were grandfathered in according to the law. Since corn starch ethanol could only contribute 15 billion gallons of the 36 billion gallons established for the RF2, EPA did not update the Life Cycle Analysis numbers for corn ethanol.

The corn starch ethanol industry has changed tremendously with new investments in efficiencies, new processes, enzymes, CO2 recovery, and co-products. The agriculture sector has also helped lower the overall carbon score through increased yields, lower inputs per bushel, new corn varieties for better starch yield, and less water usage. The recent studies have also proven that the indirect land use numbers have dropped significantly with better data and better designed models. The life cycle analyses numbers for corn to ethanol are now 40 to 50% less than 2005 base gasoline. The CO2 savings are even greater when compared to the current gasoline refined from the new feedstocks.

EPA promised to use sound science and transparency in all its rulemaking. So far this has not been the case related to accurate numbers associated with the life cycle analysis of corn ethanol. Both the US DOE Argonne National Laboratory using the GREET model in a well to wheels analysis and the USDA’s Chief Economist have published recent studies which EPA should recognize and cite.

By not using the correct life cycle analyses for corn starch ethanol, EPA is impacting the ability of the ethanol industry to export ethanol to countries that are comparing CO2 reductions across different feedstocks or establishing CO2 reduction standards. EPA by not updating their numbers or not adopting the documented results of its sister agencies is putting the U.S. ethanol industry at a distinct disadvantage.

One of the primary goals of the RFS2 was to reduce greenhouse gas emissions through the increased use of biofuels. Granting the waivers and exemptions, reducing renewable volumes, and not using sound science in their analyses EPA is violating this intent of Congress in implementing the RFS to the detriment of the consumers and biofuel industry.

We urge EPA to work harder at ensuring that programs under their jurisdiction with common goals such as reduced greenhouse gas emissions and reduced use of petroleum in the transportation sector are aligned as much as possible in their implementation and ultimate realization of goals. The two major programs with similar goals are the CAFE standards for greenhouse gas emissions reductions and improved efficiency and the RFS2. They both can have a strong relationship and benefit each other. Increasing the use of higher octane fuels with higher blends of ethanol to meet efficiency increases and greenhouse gas reduction targets under CAFE will help break the blend wall and make the RFS easier to implement with less dependency on waivers, exemptions and other detrimental actions by EPA.

Sincerely,

Aron Carlson Raymond E. Defenbaugh

Illinois Corn Growers Association Illinois Renewable Fuels Association President